Richland successfully began commissioning of the Capricorn Sapphire project in early 2015 on budget and to schedule. The Company identified the project for development due to its proven resource, mining history and the potential for profitable production from a redevelopment process needing limited expenditure. Capricorn Sapphire represents a key milestone for Richland as it looks to rapidly develop a new coloured gemstone portfolio located in mining friendly regions where a full certification process for rough gems can be put in place for product assurance.

Capricorn Sapphire will look to establish itself as a reliable supplier of natural, ethically mines gems to the global luxury good market.

Located in Queensland, Australia Capricorn Sapphire comprises two new mining leases (ML 70419 and ML70447, which were both granted on 1 April 2014 for a period of five years) comprising about 490 hectares and associated assets. The mining leases are each renewable under the Queensland Mining Act (the "Act"), if the renewal is in full compliance with the Act.

This deposit lies within the Queensland Sapphire Gemfields, located near the township of Sapphire in Central Queensland. In total the project tenements (mining leases 70419 & 70447) cover approximately 494 hectares of potential sapphire-rich alluvial placers within this known gemfield.

Resource. The two wholly owned mining leases have a JORC (2004) measured resource of 109 million carats of sapphire. The JORC (2004) resource was based on Calweld drilling (1 metre plus wide diameter rig capable of measure significant volumes of material near to surface), and bulk sampled in 1991 and later by infill drilling in 2004. An alluvial placer area of 115ha was identified that contained an estimated 22 million grams (109 million carats) at an average grade of 8g/LCM on the original Australis mining leases. As part of the JORC (2004) resource an average grade of 8 g/LCM was calculated from drilling and bulk sampling of the mining leases.

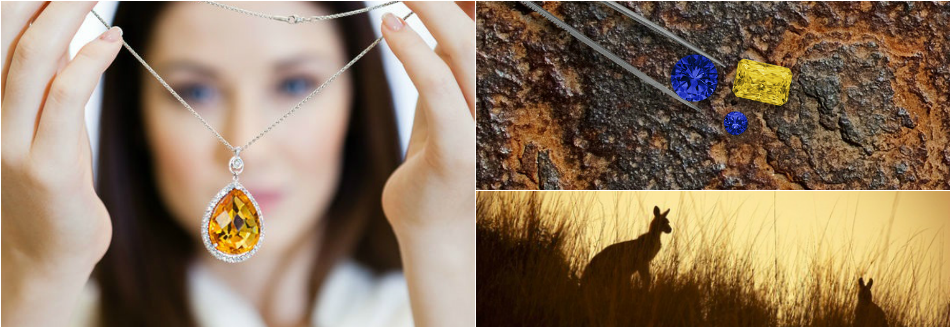

High Volume Blue Sapphires- Australia. In addition to high levels of sapphire recovered greater than 4.1 millimetres and greater than 5.5 millimetres in size, a number of "special" gemstones (those over about 10 carats in weight) have also been produced from Nardoo. Sapphires in this size range carry a significant premium to the smaller sapphires. "Special" gemstones produced during the 11 months of previous mining included a 63 carat dark blue sapphire, 41 carat yellow/green/blue fancy-colour sapphire, 33 carat yellow green sapphire, 31 carat blue sapphire, 20 carat green sapphire (see figure 2) The market for fancy colour sapphire is increasing and these gemstones attract significant interest.

Processing Plant and Equipment. At the time they commenced mining, Autralis commissioned a purpose-built alluvial processing plant which was reportedly the largest of its kind in the southern hemisphere which Richland understands had an original cost value of approximately AUD$2.5million. The processing plant was specified as being capable of treating 200 LCM per hour and consequently could potentially result in an annual sapphire production of approximately 4.16 million grams (20.8 million carats). The processing plant has remained on site and has been acquired by Richland. Independent assessment of the condition, and timescales for the re-commissioning, of the plant have been obtained.

The current mine life of Nardoo, based on the remaining and identified JORC (2004) Measured Sapphire Resource, containing an average grade of 8.0 grams per LCM, would last for approximately 5.2 years if the plant is operating at full capacity. However, Richland is assuming a more conservative throughput of 20 million grams of sapphire (100 million carats) over a period of 8 years.

Existing Distribution System. Richland’s longstanding Siteholders and marketing partners are naturally positioned as ideal candidates for supply and global distribution.

Ethical and Environmentally Sound. Australia’s international reputable status, the ethical origin, conflict free status and guaranteed authenticity of sapphires from Richland’s Australian deposit are attractive assets with today’s increasingly social conscious and educated gemstone and jeweler consumer.